Digital transformation is crucial for Africa, particularly its potential impact on sectors such as health care, education, and government. To measure the status of, and readiness for, digital transformation, one must consider the prerequisites for its realization starting with digital infrastructure and connectivity services. The COVID-19 pandemic has highlighted the importance of adequate digital infrastructure and services.

Unfortunately, many are still without access to vital infrastructure due to coverage or affordability gaps. As we have seen during the pandemic, those without connectivity are excluded from the digital economy and its benefits such as tele-health and remote learning and work. Digital infrastructure expansion and investment can help to increase internet usage and drive the digital economy.

Both globally and across Africa, internet usage and demand for services continue to rise despite economic downturns. Telecommunication services providers are facing pressure to expand, maintain, and upgrade vital infrastructure required to support vital connectivity services. The goal of greater digital transformation, and thus, infrastructure investment, will continue to shape the digital infrastructure landscape throughout 2023 and into the future.

Supply-Side Themes: Digital Infrastructure Investment Trends

Recent trends in Sub-Saharan Africa infrastructure investments include the materialization of next-generation subsea cables, as older cables approaching 20 years reach their end of life. Over the last several years, we are seeing that these submarine cables are increasingly funded by OTT players rather than traditional telcos.

Investment in long-haul terrestrial fiber networks continues, but as traditionally viable areas become increasingly connected, it can become more costly to connect small and medium sized cities. Many operators, especially in more developed markets, are more focused on densification of metro and access networks. This is vital to support 4G expansion, prepare for 5G, facilitate rollout of access fiber to drive Fiber-to-the-Home and Business plays.

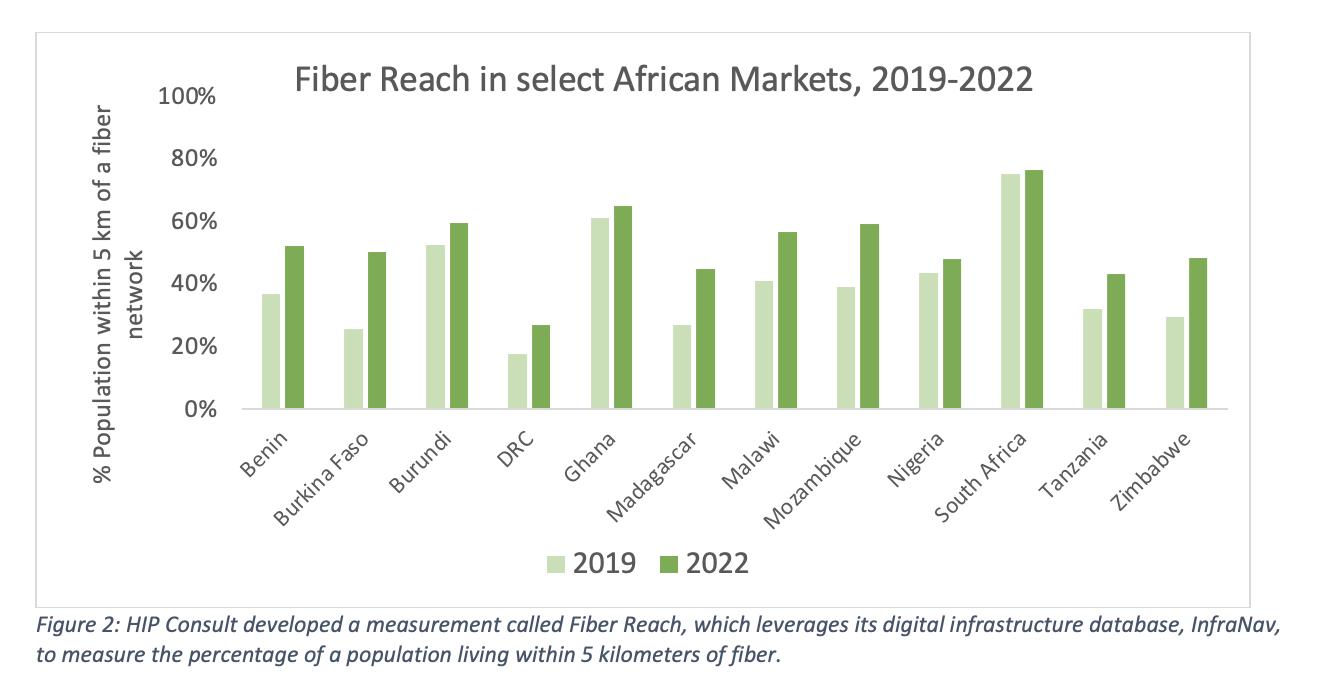

This trend can be observed in Figure 2 which illustrates how Fiber Reach (% population within 5 km of a fiber cable) has evolved in select African markets since 2019.

Plateaus in certain markets do not necessarily represent slowed network coverage, but rather an increased redundancy and densification in urban centers, with more players competing for similar customers. In certain cities, FTTx is reaching a stage of maturity where battle lines are drawn in contended cities, and internet service providers (ISPs) are starting to consolidate.

While 5G is yet to live up to its global hype, and really just getting started in Africa, the technology’s dense infrastructure requirements are driving further driving urban infrastructure densification. Commercial 5G pilots will continue to emerge, though 5G coverage and adoption may not be realized for quite some time, especially beyond the use cases such as FWA. We also expect to see the towerco industry evolve, as many MNOs sell off their assets, resulting in more funds for network expansion and cost reduction through shared Opex.

Lastly, international and local data center capacity will continue to grow quickly as longstanding capacity gaps begin to close with some high-scale investments, with “hyperscalers” begin to make a presence. While adoption of cloud services is a near-term driver, meaningful advancements in artificial intelligence and machine learning may further drive demand for cloud services in the medium to longer term.

As digital infrastructure expansion and investment becomes more nuanced, firms will require more granular insights, as well as predictive analytics, to adequately uncover potential opportunities and invest in an optimal fashion.

Questions or comments? Interested in discussing further? Contact us to arrange for a meeting with a member of the HIP Consult team.